Introduction

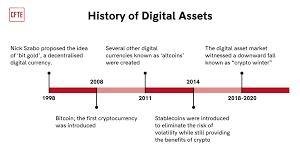

The evolution of digital assets has ushered in a transformative era that is reshaping finance, commerce, and technology.

Initially rooted in simple digital files, the concept has rapidly expanded to encompass a diverse array of assets, including cryptocurrencies, non-fungible tokens (NFTs), security tokens, and utility tokens.

This evolution has been propelled by significant advancements in technology, particularly the introduction of blockchain, which provides a decentralized and secure framework for creating, transferring, and verifying ownership of digital assets.

The launch of Bitcoin in 2009 marked a pivotal moment in this landscape, igniting the cryptocurrency revolution and prompting widespread discussions about the legitimacy of digital currencies.

Since that time, the market has experienced explosive growth, with thousands of cryptocurrencies and digital tokens emerging, each offering unique functionalities and applications, from digital art to decentralized finance (DeFi).

However, the rapid expansion of digital assets has also raised complex questions regarding regulation, security, and consumer protection.

Governments and regulatory bodies around the globe have struggled to keep pace with this innovation, resulting in a patchwork of legal frameworks that vary significantly across jurisdictions.

As we explore the evolution of digital assets, it is crucial to examine key milestones, the challenges faced by stakeholders, and the future possibilities that lie ahead in this dynamic and ever-changing digital economy.

The Rise of Digital Assets

Digital assets emerged with the advent of the internet and digital technologies. Initially, they were limited to simple digital files, but the introduction of blockchain technology in the early 2000s revolutionized the concept.

Bitcoin, created in 2009, marked the beginning of a new era in which cryptocurrencies and other digital assets gained prominence.

Early Legal Frameworks

As digital assets began to take shape, so did the legal questions surrounding them. Traditional legal frameworks struggled to adapt to the unique characteristics of digital assets.

Issues such as ownership, security, and intellectual property rights became focal points for lawmakers and regulators.

Regulatory Responses

In response to the challenges posed by digital assets, various jurisdictions implemented regulatory measures.

The United States, for example, has seen a patchwork of state and federal regulations aimed at addressing the classification and treatment of digital assets.

Agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have taken significant steps to define and regulate cryptocurrencies and tokens.

International Perspectives

Globally, countries have approached digital asset regulation differently. While some nations have embraced digital currencies and blockchain technology, others have imposed strict bans.

The European Union is working towards a unified regulatory framework with its Markets in Crypto-Assets (MiCA) initiative, aiming to create a standardized approach across member states.

Key Developments in Digital Asset Law

1. Classification of Digital Assets

One of the most critical developments in digital asset law is the classification of digital assets. Determining whether these assets are categorized as securities, commodities, or something else entirely has profound legal implications.

This classification influences regulatory oversight, taxation frameworks, and investor protections.

For example, if a digital asset is classified as a security, it falls under the jurisdiction of securities regulators, subjecting it to specific compliance requirements.

2. Consumer Protection

As the market for digital assets has expanded, the need for consumer protection measures has become increasingly important.

Regulators are focusing on ensuring that investors receive accurate information about digital assets and the risks involved.

This includes implementing regulations that require disclosures and transparency from issuers and exchanges. Enhanced consumer protection aims to prevent fraud and ensure that investors have avenues for recourse in cases of misconduct.

3. Taxation

Taxation of digital assets remains a complex and evolving issue. Different jurisdictions have adopted varying approaches to the taxation of cryptocurrencies and tokens, leading to confusion among investors and businesses.

Clarifying tax obligations for transactions involving digital assets is an ongoing challenge, as regulators seek to establish clear guidelines for reporting and compliance.

4. Smart Contracts

The rise of smart contracts has introduced new legal considerations that are shaping digital asset law. Smart contracts are self-executing agreements with the terms of the contract directly written into code on a blockchain.

This innovation raises questions about the enforceability of such contracts, liability in case of errors, and the applicability of traditional contract law principles.

As smart contracts become more prevalent, legal definitions and frameworks will need to adapt accordingly.

5. International Regulatory Cooperation

As digital assets operate on a global scale, international regulatory cooperation has become essential. Different countries have taken varied approaches to digital asset regulation, leading to potential conflicts and regulatory arbitrage.

Initiatives like the European Union’s Markets in Crypto-Assets (MiCA) aim to create a unified regulatory framework across member states, promoting consistency and clarity in the treatment of digital assets.

6. Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

With the growing popularity of digital assets, regulators have intensified their focus on combating illicit activities associated with cryptocurrencies, such as money laundering and fraud.

Many jurisdictions have implemented AML and KYC regulations that require exchanges and service providers to verify the identities of their users and report suspicious activities.

These measures aim to enhance security and promote trust in the digital asset ecosystem.

Frequently Asked Questions

What is a digital asset in law?

A digital asset in law refers to any form of content or value that exists in a digital format and is owned by an individual or entity.

This includes a wide range of items such as cryptocurrencies, tokens, digital media, and other electronic assets.

When did digital assets begin?

Digital assets began to emerge in the early 2000s. However, the launch of Bitcoin in 2009 marked a significant turning point, leading to the proliferation of cryptocurrencies and the broader category of digital assets.

What is the creation of digital assets?

The creation of digital assets involves utilizing technology, particularly blockchain, to generate unique digital tokens or currencies.

These tokens can represent ownership, value, or access to specific goods and services, enabling new forms of transactions and interactions in the digital economy.

What are the three main categories of digital assets?

The three main categories of digital assets are:

- Cryptocurrencies: Digital currencies used primarily for transactions, such as Bitcoin and Ethereum.

- Non-Fungible Tokens (NFTs): Unique tokens that represent ownership of specific items, such as art, collectibles, or virtual real estate.

- Utility Tokens: Tokens that provide users with access to a platform or specific services, often used in decentralized applications.

Who is the founder of digital assets?

While Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is often credited with the founding of digital assets due to the introduction of blockchain technology, the evolution of digital assets has involved contributions from many individuals and organizations across the globe.

The landscape continues to grow with innovations from various developers and communities.

By understanding asset law and its implications, stakeholders can better navigate the complexities of this dynamic landscape, ensuring compliance and leveraging opportunities for growth in the digital economy.

RELATED ARTICLES

Digital Asset: Meaning, Types, and Importance

https://www.investopedia.com/terms/d/digital-asset-framework.aspEdit